Our investment philosophy

Ausbil’s broad investment philosophy is that active management of our portfolios facilitates consistent and risk controlled outperformance. Rather than focusing just on growth or value investing, our investment approach allows us to exploit the inefficiencies across the entire market, at all stages of the cycle and across all market conditions.

We are a top down, bottom up investment manager.

We believe that the Australian equity market is relatively efficient, but not perfect. Our combination of top down macroeconomic research with in-depth bottom up stock analysis gives us better insights into the earnings profile of our universe of companies during the various stages of the economic/investment cycle.

The basic premise of our philosophy is that stock prices ultimately follow earnings and earnings revisions. We believe that the market places excessive emphasis on the current situation and does not sufficiently take into account the likelihood of future changes to the earnings profile of individual companies and sectors.

Investment Process

Our process seeks to identify earnings and earnings revisions at an early stage, and hence to anticipate stock price movements. We seek to position our portfolios towards those sectors and stocks which we believe will experience positive earnings revisions and away from those we believe will suffer negative revisions. At any time, our portfolio will be tilted toward stocks which afford the most compelling opportunities for appreciation over the coming twelve months.

Our investment process has been pioneered and successfully implemented by Ausbil investment professionals since inception and has produced returns consistently above benchmark performance over this period.

We classify our investment style as core 'style neutral'; wherein at certain stages of the cycle the portfolio may have a value or growth tilt as markets provide opportunities for particular types of stocks to enjoy earnings growth.

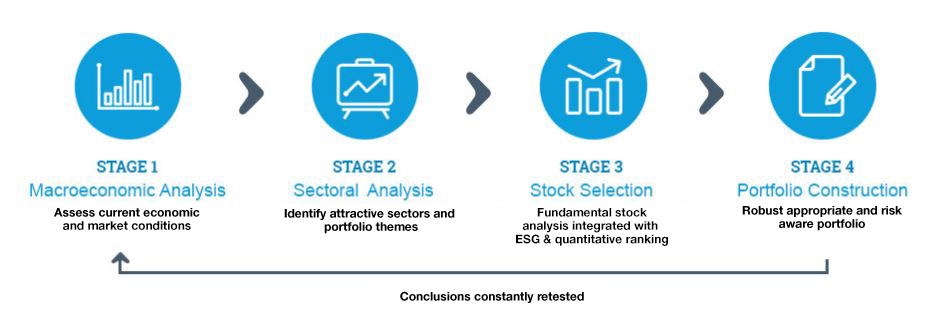

Stage 1

Seeks to assess the current market conditions impacting on the Australian equities market to determine Ausbil’s view of the macro framework and thus set an overall portfolio strategy.

Stage 2

The application of Stage 1 conclusions to each sector to identify at an early stage, sectors subject to earnings revisions - both upward and downward over the coming 12 month period.

Stage 3

Identification of those stocks we believe will achieve the greatest 12 month outperformance within the investment universe. Given our belief that earnings and earnings revisions lead stock prices, the analyst’s primary objective is to investigate and assess all facets impacting on each company’s earnings profile. Analysts undertake fundamental analysis, a program of company visitations and utilise our proprietary quantitative ranking model.

Stage 4

Portfolio construction creates a robust, appropriate and risk aware portfolio which conforms to (and optimises) the conclusions of the previous three stages of the process.